Reduce the commercial risk when trading internationally: 5 ways

Here at Venerable Capital we know how hard it is to initiate international export and increase your growth. Despite the presence of online channels and a more interconnected environment, there are still a number of problems you can stumble upon when taking on international trade or export. We will tackle these issues and try to give you a clearer view on how to reduce the commercial risk when trading internationally.

Commercial Risk

Both importing and exporting companies face a significant risk when they trade with foreign countries. There are a number of problems that are more or less easily solved or avoided such as different corporate cultures, language barriers, unknown trading partners, the delivery of the goods, and punctual payment. But the most important risk is the commercial risk, also known as the default risk. This occurs when the buyer is unwilling or unable to fulfill the contractual obligations to pay for the purchased goods. As an exporter, this is extremely frustrating. Delivering the goods and not receiving payment is not sustainable and a threat for your business. There are a number of things a company can do to counteract this problem.

1. Prepayment – Reduce Commercial Risk

You can ask your trading partner to pay you before producing or delivering the goods. Suppose that you have produced a great load of product for a client, but all of a sudden they don’t need it anymore. Now you are stuck with a lot of products you don’t have a buyer for, and where you invested a lot of time, effort and money in. Asking for a prepayment is a good way to avoid this situation. Although it is not the most customer-friendly solution. This can create a sense of suspicion or distrust. Usually you can only ask this once from your client, as this is a short-term solution. This is the most efficient and secure way to reduce the commercial risk.

2. Debt Collection Procedure – Reduce Commercial Risk

A debt collection procedure is the procedure that is started by a collection agency with the goal being the collection of an order. There are a number of steps in this process that we will discuss below.

1 – The own collection process: in this (internal) phase, the creditor himself tries to get his invoices paid. For example, by calling his client and sending payment reminders and demands.

2 – The out-of-court or amicable debt collection process: in this (external) phase, the creditor appoints a professional debt collector who attempts to collect the debt out-of-court by taking all kinds of collection measures.

3 – The judicial collection process: in this phase, the creditor goes to court to obtain payment of his claim or by taking other legal measures, such as a prejudgment attachment or filing for bankruptcy of his debtor.

4 – the enforcement phase: in this phase the judgment is enforced by means of seizures.

Using this method to collect your payment is not the nicest way. After executing this you will probably lose your client. The agency or professional debt collector will also ask for a fee or commission. So you have to weigh up the costs and benefits in relation to reducing the commercial risk.

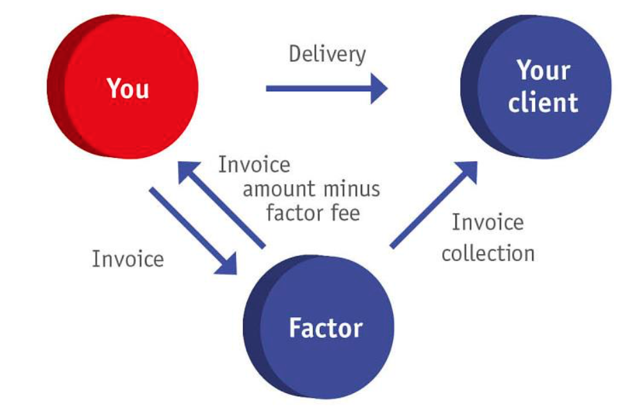

3. Factoring – Reduce Commercial Risk

In short: factoring is the outsourcing of your trade receivables management. As you no longer manage your trade receivables, only the commercial relationship with your client remains. The difference with a professional debt collector is that you only appoint a debt collector if the customer does not pay. So this is when the problems already occurred. Factoring can be used from the beginning.

Step 1 – Transfer of your portfolio

You transfer your portfolio to the factoring agency. Depending on the type of portfolio, the cost of this will be a percentage of the turnover.

Step 2 – Financing

The factoring agency transfers you an advance of the customer’s payment. This reduces the need for net working capital.

It is worth knowing that the factoring agency takes no risk: the risk remains within your company. If the customer does not pay, the risk remains with you. The decisive reason to opt for this procedure is financing: this means that people get their money immediately. That is the only reason why they go to a factoring agency.

4. Documentary Credit – Reduce Commercial Risk

With the Documentary Export Credit, a credit-opening bank (the of the foreign buyer) enters into an irrevocable commitment to pay you (the exporter) according to the signed documents. Therefore, you can be sure that you will actually be paid after delivery of goods to a foreign buyer.

You allocate a bank to intermediate. The bank will check the flow of goods. If all the documents, deliveries, etc. are correct, you can be certain of your payment. This occurs mainly when it is a matter of containers of thousands of euros, to ensure everything is to the letter. If there is even a small mistake inside the documents, the money will not be paid. It is a huge follow-up and a lot of files. Luckily, now this process goes automatically. What are these documents that are so important to be completely correct? The letter of delivery, the invoice (must be properly drawn up according to the agreements), origin certificate, …

This is a very strong way to hedge yourself against default and reduce the commercial risk. We see this happening a lot when trading with the Middle East. This is not commonly used in trade with France for example. Because this is way closer to home, and you can just drive your car to the defaulting trading partner.

5. Credit Insurance

A credit insurance company does not take over the trade, but insures your trade receivables. They will pay you if the customer goes bankrupt or does not want to pay.

The credit insurance company will execute a preventive test, an assessment of creditworthiness of the client. When the client is creditworthy, they will set limits for sales to customers. This gives more protection against non-payment in difficult markets. You have to keep in mind that the full amount will not be insured, only apart from it. So in case of non-payment you will not recover 100% of your debt. Always make a cost/benefit analysis: credit insurance premiums versus losses due to non-payment. To reduce the commercial risk, you will always have to pay a price.