Alcohol export taxes in Spain

Good morning everyone and welcome one more day to our blog. As you know, Venerable Capital is a company specialized in the export of alcohol. Therefore, today we will talk about the alcohol export taxes in Spain.

Before commenting on taxes on alcohol exports in Spain, it is important to know what documents we will need to have completed before starting our activity.

Customs documents to export

Like any bureaucratic procedure, when it comes to exporting alcohol, it is necessary to have completed different mandatory administrative documents to perform your activity. The most important are the EORI and the DUA:

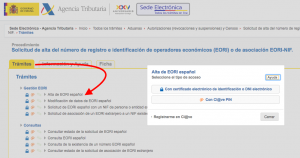

¿What is EORI?

Economic Operator Registration and Identification Number (EORI) is an identification number, unique in the European territory for exporting and importing countries, established by the Community policies on import and export.

It is obtained in a simple way, unless the NIF of the company starts with N, M, X or Y, in which case it will be obtained at the same customs or Treasury, activating the identifier at 48 hours.

¿What is DUA?

Documento Único Administrativo, in Spanish, (Single Administrative Document in English), is the export declaration in paper support, which is required by customs. It has the character of a tax declaration, having an important function in providing detailed information on the exported product.

Taxes on alcohol exports in Spain

To know what amount of tax is applied to the shipment to be exported, it is necessary to know what type of alcohol is going to be transported. We will differentiate between beer taxes, wine taxes and alcohol taxes.

Beer export taxes

The tax base on beer is constituted by the volume that is exported, all calculated by hectoliters. In this way, if the alcohol graduation does not exceed 1.2, no taxes will be paid. As the graduation increases, taxes range from € 2.75 to € 13.56 per hectolitre.

Wine export taxes

In the same way as beer, the tax base of wine is constituted by volume, in hectoliters. Thus, regardless of whether it is a sparkling or calm wine, the tax base is 0 pesetas per hectoliters.

For this type of beverages, the tax base will be taken into account by the volume of pure alcohol, expressed in hectoliters, contained in the products that you want to export.

This way, the required tax will be € 958.94 per hectolitre d alcohol pure exported.All procedures require a lot of time, patience, bureaucratic procedures and a host of etc.

Therefore, if you are thinking of exporting alcohol to other countries, such as in Africa, we are the best option, since we are present in different markets. For more information, do not hesitate to contact us. Until the next post!